2024 Max Gift Amount

2024 Max Gift Amount. The 2024 gift tax limit is $18,000. • 1mo • 5 min read.

Any gift from a relative (including parents) is non taxable. The gift tax is intended to discourage large gifts that could.

The Annual Gift Tax Exclusion Will Be $18,000 Per Recipient For 2024.

They are a strategic marketing tactic creating anticipation among players.

1 For 2024, The Limit Has Been Adjusted For Inflation And Will Rise To $18,000.

The annual exclusion applies to gifts to each donee.

The Combined Gift And Estate Tax Exemption Will Be $13.61 Million Per Individual For Lifetime.

Images References :

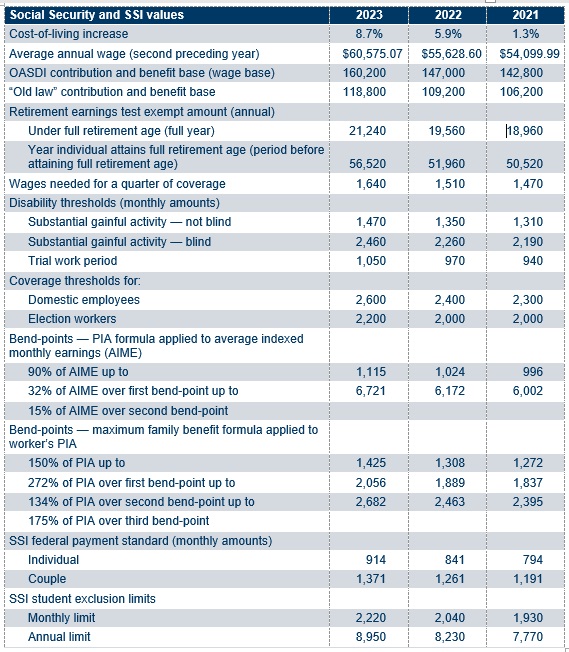

Source: www.mercer.com

Source: www.mercer.com

2023 Social Security, PBGC amounts and projected covered compensation, In 2024, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. They are a strategic marketing tactic creating anticipation among players.

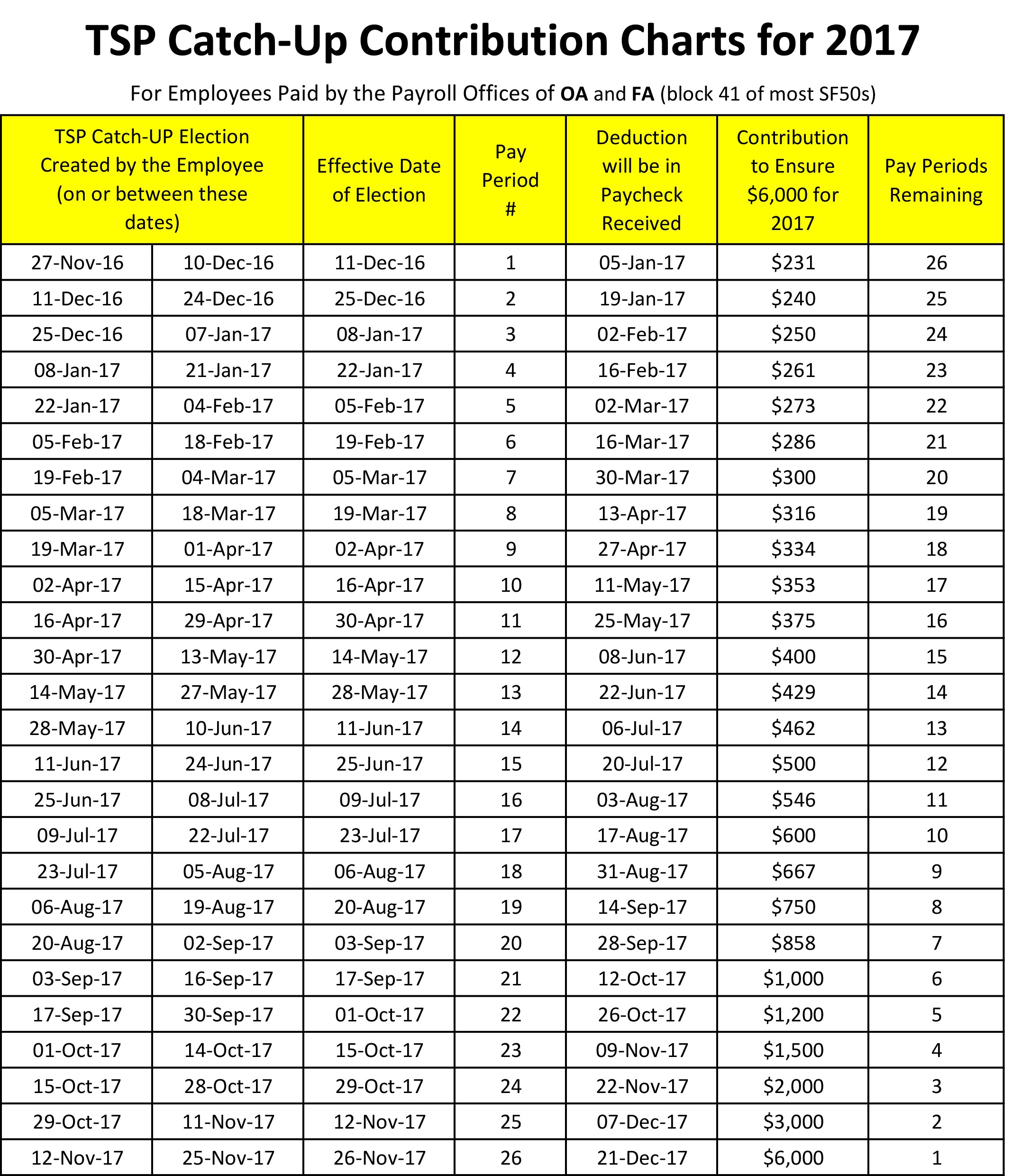

Source: admin.itprice.com

Source: admin.itprice.com

2023 Tsp Maximum Contribution 2023 Calendar, They are a strategic marketing tactic creating anticipation among players. The 2024 gift tax limit is $18,000.

Source: choosegoldira.com

Source: choosegoldira.com

self directed ira contribution limits 2022 Choosing Your Gold IRA, The annual gift tax exclusion will be $18,000 per recipient for 2024. Such a gift in the form of bank transfer is non taxable.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, For married couples, the limit is $18,000 each, for a total of $36,000. The gift tax limit (or annual gift tax exclusion) for 2023 is $17,000 per recipient.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, How are gift and estate taxes figured? The combined gift and estate tax exemption will be $13.61 million per individual for lifetime.

Source: deidreqardelis.pages.dev

Source: deidreqardelis.pages.dev

Healthcare Marketplace Limits 2024 Danny Orelle, The table below shows the annual exclusion amount applicable in the year of the gift. The annual exclusion applies to gifts to each donee.

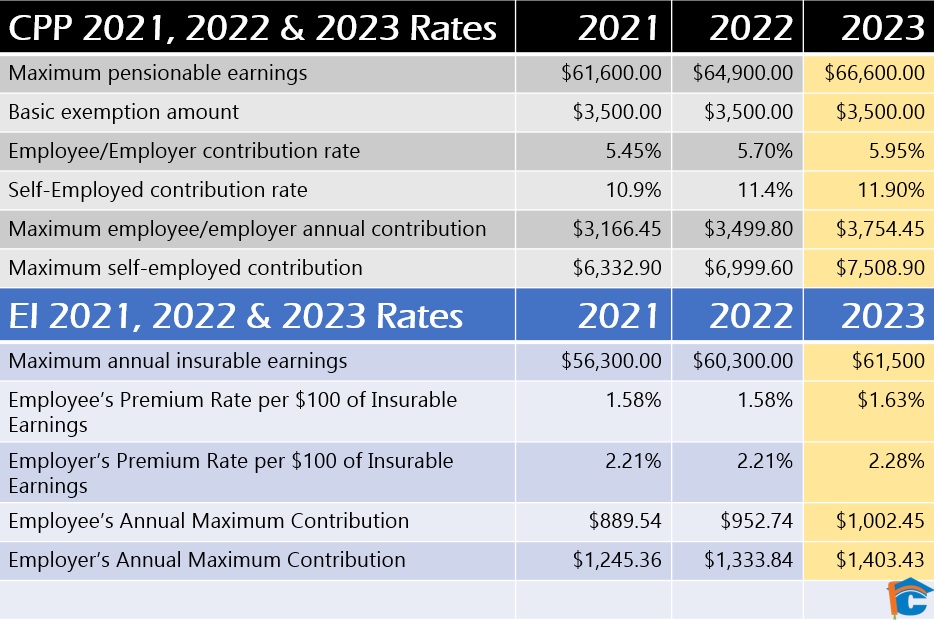

Source: www.fintechcollege.ca

Source: www.fintechcollege.ca

CPP EI Calculations 2022 and 2023 FinTech College of Business And, How are gift and estate taxes figured? The annual gift tax exclusion of $18,000 for 2024 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax.

Source: www.youtube.com

Source: www.youtube.com

Early Estimates SSI Check Amounts for 2024 YouTube, Published march 26, 2024 updated march 27, 2024,. The combined gift and estate tax exemption will be $13.61 million per individual for lifetime.

Source: blog.seedly.sg

Source: blog.seedly.sg

CPF Contribution Rates 2023 All You Need To Know About the Latest, The annual amount that one may give to a spouse who is not a us citizen will increase to $185,000 in 2024. The combined gift and estate tax exemption will be $13.61 million per individual for lifetime.

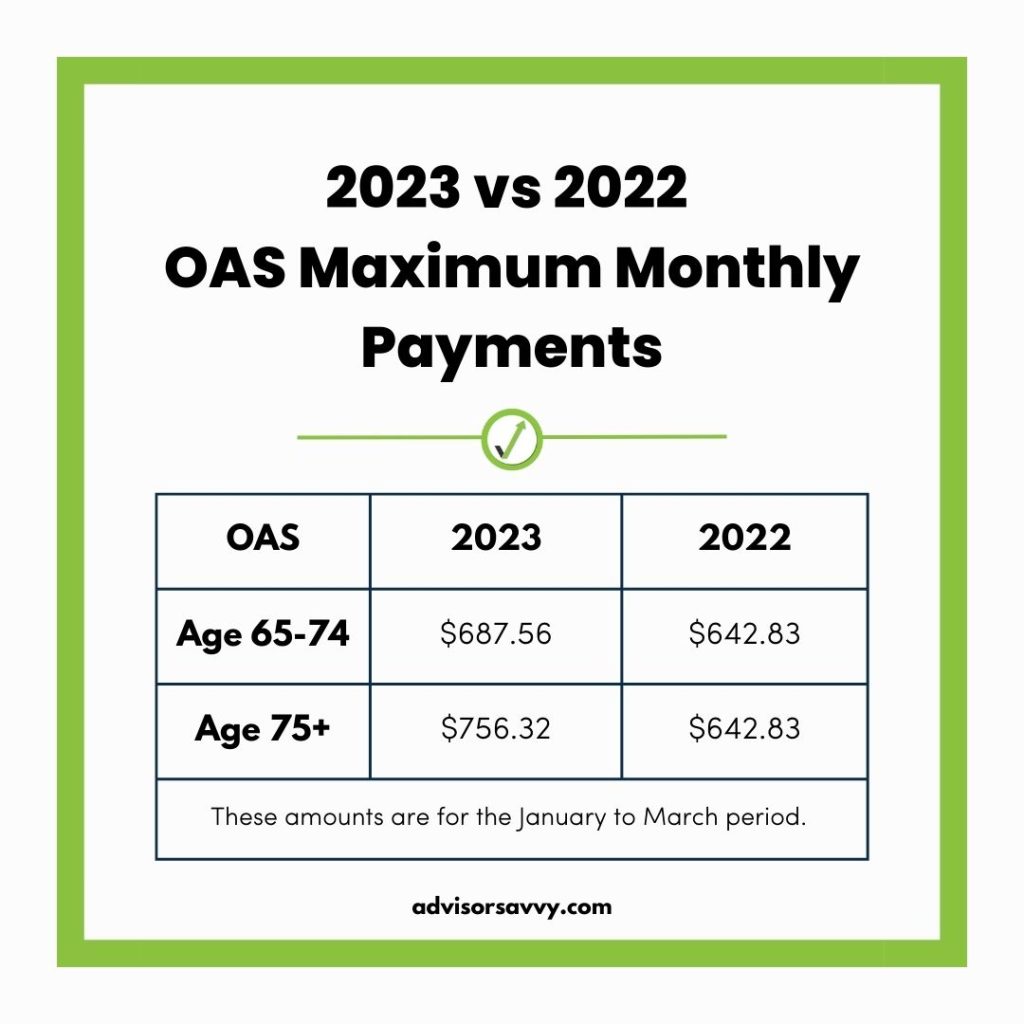

Source: advisorsavvy.com

Source: advisorsavvy.com

Advisorsavvy Old Age Security Increase in 2023 What You Need to Know, 2024 lifetime gift tax exemption limit: How are gift and estate taxes figured?

Embark On An Enriched Gaming Adventure With Exclusive Redemption Codes From Garena Free Fire Max.

The table below shows the annual exclusion amount applicable in the year of the gift.

How Are Gift And Estate Taxes Figured?

2024 lifetime gift tax exemption limit: